Apple Pay’s Global Push Ignites Mobile Wallet Showdown

Apple Pay, the tech giant’s mobile wallet solution, is preparing another global expansion. Their new, aggressive strategy has one clear goal: establishing market presence in booming fintech markets worldwide – particularly in established markets with high smartphone penetration and emerging economies where mobile adoption is on the rise.

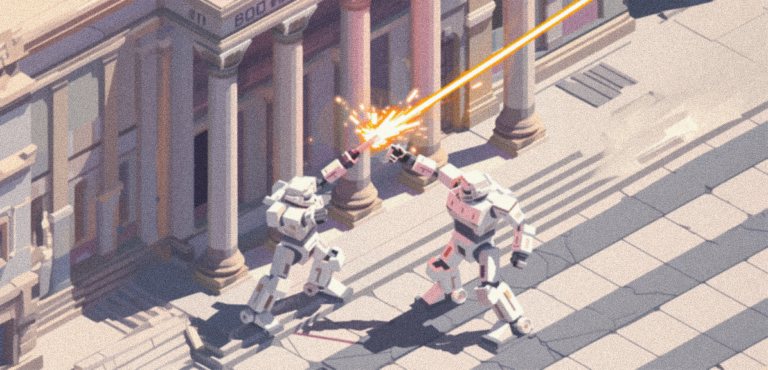

The move signals Apple’s intent to continue as a major fintech player and it sets the stage for a fierce competition. This isn’t just a fight for dominance – it’s a consumer clash between Apple’s secure, closed ecosystem and the open, collaborative approach favored by many competitors.

The outcome will impact users, developers, and the entire future of mobile wallets. Get ready, because the mobile wallet war is on.

Set the stage with Apple Pay vs. Samsung Pay

Prior to this strategic shift, Apple Pay’s primary focus was on developed regions with a high concentration of iPhone users. This strategy ensured strong brand recognition and user adoption within a specific demographic. However, the new international expansion plan signifies Apple’s intention to compete directly with established players like Samsung Pay in markets where competition has carved out a significant market share like South Korea, India, Russia, Australia, and Brazil.

When it comes to core functionalities, both Apple Pay and Samsung Pay offer convenient and secure ways to make contactless payments. However, their approaches differ in key aspects:

- Security: Apple Pay prioritizes robust security features. It leverages the iPhone’s Secure Enclave and biometric authentication (Touch ID/Face ID) for secure transactions. This approach has fostered a strong reputation for trust among Apple users but limits access to Apple devices.

- Openness: Samsung Pay prioritizes openness. It supports a wider range of Near field Communication (NFC)-enabled devices (not just Samsung smartphones) and partners with a broader spectrum of financial institutions. This strategy has helped Samsung Pay gain traction in regions where affordability and device diversity are crucial factors.

Beyond the giants toward the rise of regional players

The Apple Pay and Samsung Pay developments are just the tip of the iceberg. As mobile payment adoption continues to surge globally, we can expect to see a rise in regional players and niche fintech solutions. These regional players will cater to specific market needs and preferences, offering users a wider range of options tailored to their local context.

For instance, mobile wallet solutions in developing economies may prioritize features like offline functionality (for regions with limited internet connectivity) or micropayment capabilities (to cater to smaller transaction sizes). Additionally, these regional players may have existing partnerships with local banks and financial institutions, offering users a more streamlined onboarding experience.

Other global players in the mobile wallet arena

While Apple Pay and Samsung Pay are undoubtedly major forces, they aren’t the only players. Here are some other key participants:

- Google Pay: A strong contender with seamless integration into Google services and a focus on open partnerships.

- Alipay and WeChat Pay (China): Dominant forces with a comprehensive ecosystem beyond payments.

- PayPal: A well-established player in online payments, making strides in mobile wallets, particularly for cross-border transactions.

- Regional Players: M-Pesa (Africa), Paytm (India), GrabPay (Southeast Asia) cater to specific regional needs.

Developers take centre stage: the role of open ecosystems

The global expansion of mobile wallets also has significant implications for developers and fintech startups. The industry will be closely watching to see if Apple maintains its exclusive approach or opens Apple Pay’s functionalities to a broader developer ecosystem. Samsung Pay’s openness in this regard has been a factor in its appeal to developers, allowing them to integrate mobile wallet functionalities seamlessly into their applications.

An open ecosystem would encourage the development of innovative applications and services that leverage mobile wallets for a wider range of purposes, such as loyalty programs, ticketing solutions, and peer-to-peer payments. This would ultimately benefit users by offering them a more integrated and comprehensive mobile payment experience.

A boon for users: increased competition breeds innovation

Apple Pay’s global expansion holds exciting possibilities for users. Increased competition between mobile wallet providers will likely drive innovation in the fintech sector. As technology evolves and new threats emerge, we can expect to see both Apple Pay and Samsung Pay, along with other players, invest heavily in enhancing their security protocols.

With a focus on attracting and retaining users, mobile wallet providers are likely to prioritize user experience. This could translate to smoother integration with existing financial platforms, faster transaction processing times, and more intuitive user interfaces. Users may benefit from lower fees or more transparent pricing structures as mobile wallet providers vie for market share.

Of course, the global expansion of mobile wallets also comes with its own set of challenges. Regulatory hurdles related to data privacy and security will need to be addressed to ensure user trust. Standardization across different regions, with varying financial infrastructures and regulations, will be another hurdle to overcome.

Additionally, ensuring widespread adoption across diverse demographics and geographic locations will require addressing issues of financial inclusion and digital literacy. Initiatives that bridge the digital divide and educate users about the benefits and security features of mobile wallets will be crucial for achieving true inclusivity.

Distilled

The mobile wallet landscape is undergoing a period of exciting transformation. Apple Pay’s global expansion marks a significant step in this direction, and the implications are far-reaching. Increased competition, the rise of regional players, the potential for collaboration, and continuous innovation will all contribute to shaping the future of mobile wallets. Ultimately, this evolution holds the potential to create a more convenient, secure, and inclusive financial ecosystem for users around the world.